Is concierge medical care a tax deduction? As our healthcare system becomes more bloated and inefficient, the cost of health care seems to keep going up, while the quality is going down.

That’s why a lot of people are opting for “concierge” healthcare for a more personal experience. Getting more quality attention and face time from doctors isn’t cheap though, usually costing an additional $1,800-4,500 a year on top of your regular health insurance. At tax time you’ll want to make sure you deduct it, if it qualifies as actual “services.”

If It’s a Health Care Service, It’s Tax Deductible

Concierge health care is a tax deduction, provided that the money goes to healthcare services like examinations and routine physicals. Of course, elective “services” like plastic surgery or hair transplants are usually not deductible.

Is Paying a Concierge Doctor a Retainer a Tax Write Off?

It’s not as cut and dry when you pay a doctor or health care professional a retainer, but the same rule applies. If you are paying for services, then it is a viable tax deduction. Simply paying for access without actual services is not a deduction.

Retainers must be itemized on your taxes to qualify as a write-off.

Concierge Healthcare: Claiming a Tax Write-Off

If you take a standard deduction for medical expenses, paying concierge fees won’t affect your taxes. If you are trying to get a deduction, both concierge services must be itemized in your taxes. All medical costs are itemized as deductions on Schedule A.

Remember, you must subtract any reimbursements from your insurer and 10% of your adjusted gross income from these expenses before claiming a deduction.

Concierge Health Care: A Good option for Both Patients & Doctors

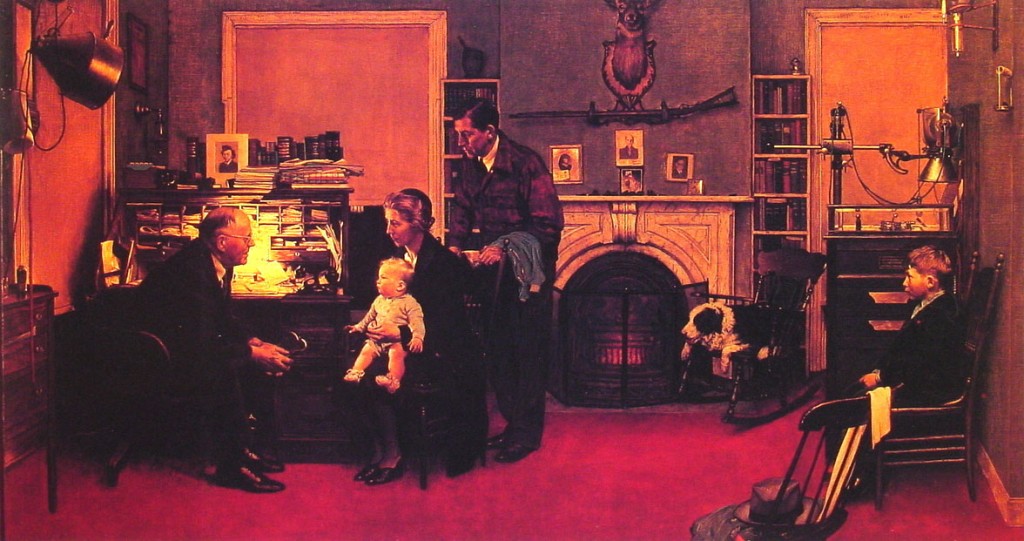

Definition: Concierge medicine (aka “retainer medicine”) is a relationship between a patient and a primary care physician in which the patient pays an annual fee or retainer.

The doctor will see you NOW… No, seriously, there’s usually no wait. You won’t even get the flu while being coughed on for an hour in the waiting room.

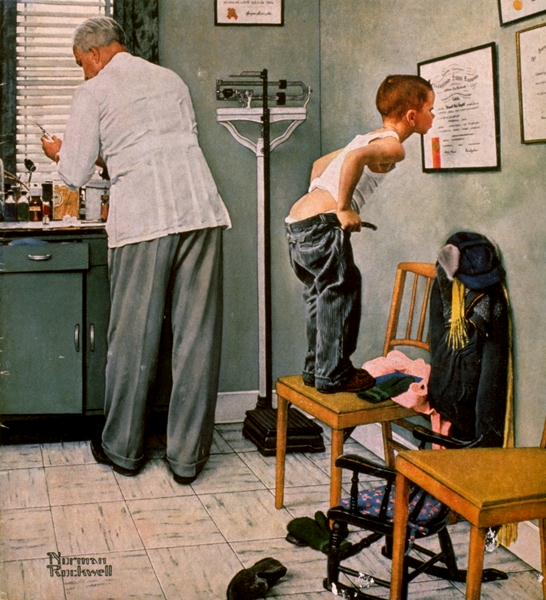

It’s not just the patients that don’t like the current state of healthcare. Doctors are frustrated too. Bogged down with more paperwork, and allotted shorter visits with patients, they often feel they aren’t given the time and tools to do their job properly.

Did you know a doctor may only be given 5-7 minutes per visit with a patient?

That’s why a growing number of primary care doctors are leaving the medical rat race and starting their own, smaller practices; typically seeing a fraction of the number of patients and offering more personalized health care. Some doctors even offering house calls with your concierge service.

More about concierge medicine – kiplinger.com

Is the Extra Concierge Health Care Cost a Good Idea?

Sure, doctors make a good salary, but apparently it’s the lawyers who make a killing, with hourly rates recently touching $1500 per hour. So, now paying the doctor $200 extra per month for his undivided attention doesn’t sound so unreasonable, right?

If you make more than average number of visits to a doctor each year, or find yourself cursing the lines at the doctor’s office, you might consider the concierge option, which seems to be fairly priced in most practices. (check to see what the differences are if you are filing your taxes in Canada)

A friend of mine who had a heart condition knew that she was in for an extended period of time where she needed personalized attention, and her concierge doctor greatly helped to stay on top of her situation. In her case, he also served as a liaison between the other doctors / specialists who she was seeing.

In her case, she was happy to pay the extra money for better service, and spent much less time in waiting rooms or on “hold” with an assistant. She also was able to call her doctor directly with questions, and in many cases concierge doctors will even make house-calls.