How much does it cost to file my tax return with H&R Block? You know that H&R Block (coupons) is one of the most well-known and respected names in taxes, but you may not know how much it really costs to file your taxes with them.

The first thing you should decide is whether to file your taxes online, download software, or file in person at one of their hundreds of locations nationwide. The least expensive and most popular way to file is online, and when you apply our discount you’ll save even more.

Here’s our best discount for H&R Block Online and Download plus pricing for Deluxe, Premium, Premium & Business, and Self-Employed in 2023:

H&R Block cost: Best Offers | Online & Download | In-Person | Best Price

Best Offers Now:

Save up to 25% on the cost of H&R Block with the offers above. Here’s how much H&R Block Online and Download products cost.

H&R Block Pricing + State Fees for 2023:

Here is the new pricing for Online and Download products with our best discount applied:

| ONLINE† | DOWNLOAD* | |

|---|---|---|

| FREE: | $0 (+ $0 State) | NA |

| BASIC: | NA | |

| DELUXE: | ||

| PREMIUM: | ||

| SELF-EMPLOYED: | NA | |

| PREMIUM & BUSINESS: | NA |

†Online products include Federal e-file at no extra cost + $49 per state efile

*Download editions also cost an extra $19.95 per state e-file. Additional state programs cost $39.95 each

Tip: H&R Block pricing is lower early in the tax season and increases after March 15th, and we also have coupons here!

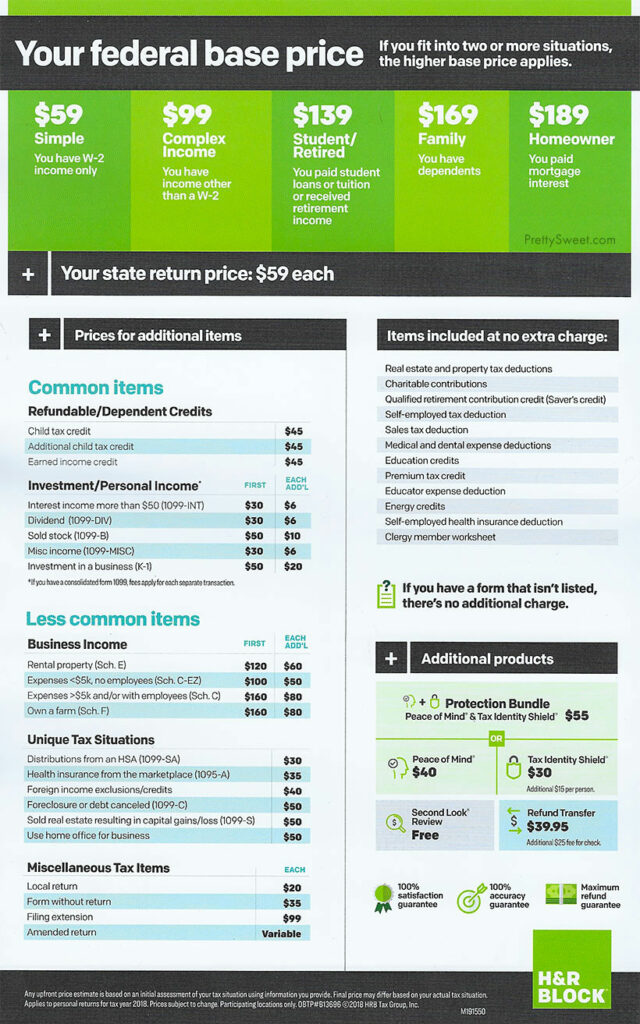

H&R Block In-Person Pricing + Fees:

How much does H&R Block charge to do taxes in-person? The cost to file your taxes in person at an H&R Block store location depends on the complexity of your taxes and how many states you need to file in. Here are the base prices plus additional fees and state filing fees:

1. Base Price:

- Simple: (+ $59) You rent and have W-2 income only

- Complex Income: (+ $99) You have income other than a W-2

- Student or Retired: (+ $139) You paid student loans or tuition, or collected retirement income

- Family: (+ $169) You have dependents such as children. *Needy cats or small dogs don’t count!

- Homeowner: (+ $189) You have a mortgage

2. Additional Fees:

Extra fees on top of these base prices can be significant including business expenses (Schedule C), investments, rental property, and filing an extension.

Here is a price list with additional fees to help you estimate the cost of filing in person at your local H&R Block store:

Tip: Amended Return fee: H&R Block charges a variable fee of approximately $89 to file your amended return after the tax deadline

3. State filing fee:

Add an additional $59 filing fee per state when you file in-person.

How to Get the Best Price:

Follow these steps to get the best price when filing your taxes with H&R Block:

- Choose to file online instead of downloading software, buying in-store, or filing in-person

- Compare editions to buy the appropriate one for your needs

- Use our featured discount for the best price on online products

- File your tax return early as H&R Block pricing increases after March, 15th

Follow these steps and you should get the best possible price when filing your taxes with H&R Block. I hope we’ve helped you save on the cost of H&R Block, but if you aren’t sure you’d like to file with them, we also have exclusive deals for Turbo Tax (cost?), QuickBooks, and TaxAct (cost?).

If you’d like to estimate your tax refund, H&R Block has a free tax calculator on their site here.

Thanks for visiting Mighty Taxes!