Are you an active-duty member of the U.S. Military? If so, you’ll want to check out TurboTax’s special Free Military Edition.

TurboTax for Military was designed to address the specific challenges that come with being active duty, reserve, or veteran (retired) military personnel (or spouse) tax filer. TurboTax Military Edition helps to ensure that you get the maximum refund possible and includes free Federal and State e-file for active-duty military.

Everything from education assistance to moving expenses to EITC (Earned Income Tax Credit) are potential tax deductions for members of the military!

Not active duty military? Veterans of the armed services and USAA members can also get a great discount of $5-20 on TurboTax when filing their Federal and State taxes. Here’s what you should know about TurboTax for Military, USAA, National Guard, and Veterans:

TurboTax: Military Discount | Not Applied? | Free | Veterans | USAA | First Responders

TurboTax Discounts for Military:

- TurboTax Military Edition – FREE for most active duty military – 2024

- TurboTax $5-20 Off – BEST for Veterans, USAA, and first responders. Discount applies to online products including Deluxe and Premium – 2024

Is TurboTax Free for Active Duty Military?

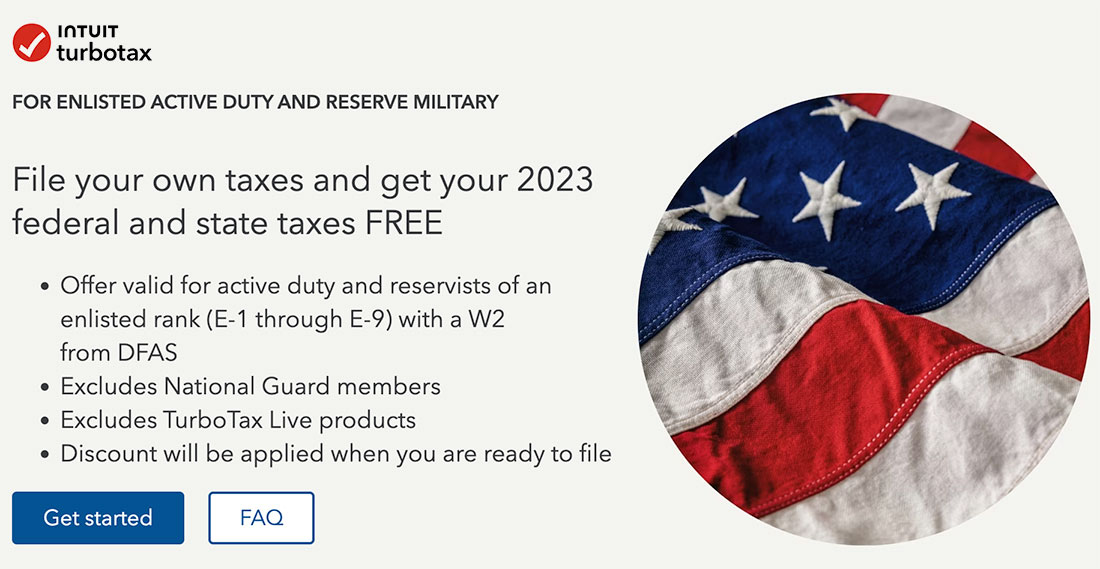

TurboTax Online is now FREE to enlisted active duty military, reservists, and National Guard ranks E1-E9! (TurboTax Live and download products are not included)

How to get TurboTax Military free: Just enter your W-2 and verify your military rank when using a TurboTax Online product to qualify. You can start here, and your discount will be applied when you are ready to file:

Veterans, retired military, and USAA members do not currently qualify for TurboTax Military Free. However, you can still get a $5-25 discount on TurboTax Online products with no need to enter a service code.

TurboTax Military Discount Not Applied?

The TurboTax Military discount is available to active duty and reservists of an enlisted rank E-1 through E-9. Simply use your military W-2 from DFAS to verify rank and your discount will be applied when you file. If the discount is not applied it could be because you don’t qualify or because Live products and National Guard members are excluded. For more information click here

Turbotax Veteran or Retired Military Discount?

Currently, there is no specific TurboTax discount for veterans of the Army or Navy or retired military members. However, you can get the best price with their current discount advertised to civilians and veterans alike from our semi-exclusive offer page.

You can find military and veteran discounts from dozens of online stores here.

TurboTax military discount not applied? When you start filing your taxes you’ll have a chance to claim your status as active-duty military. When verified, qualifying members of the military will file for free. If your discount is not working, try logging out, then log in again and click the promotional link to apply the discount.

Do USAA members Get a Discount on TurboTax?

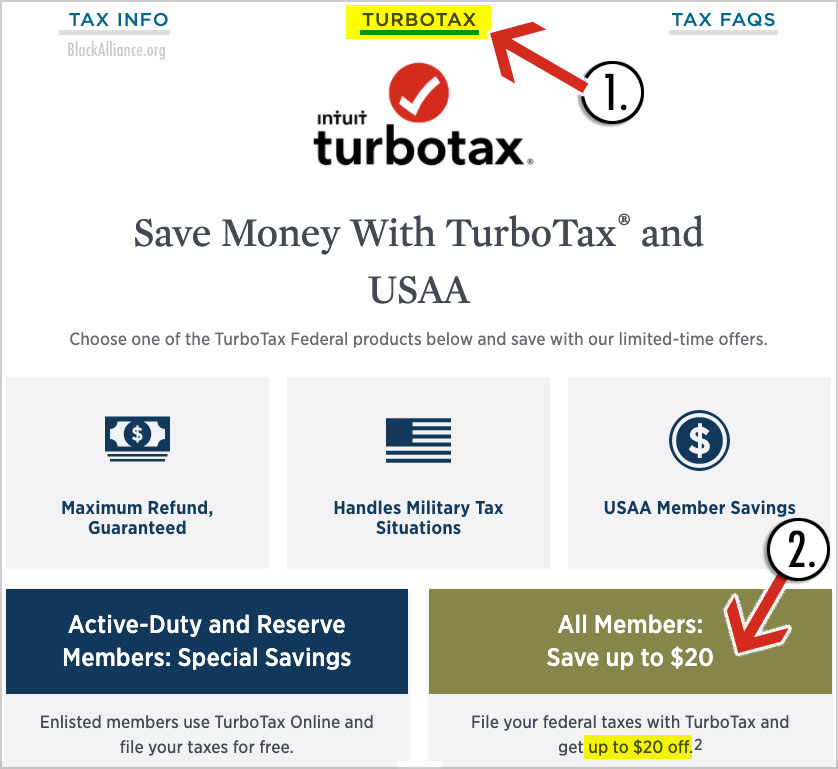

TurboTax does not provide a discount on their products specifically for USAA members directly through their site at turbotax.intuit.com. However, if you are a member of USAA you can access several tax-related forms discounts from the USAA tax center at USAA.com. Just log in and then click the “TurboTax” link like this:

You’ll then see the link to the USAA TurboTax discount for up to $20 online editions.

Tip: Looking for a TurboTax USAA discount? Go through your USAA online account to the Tax Center or access the same $5-20 discount directly here!

Is There a TurboTax First Responder Discount Code?

Currently, there is no specific discount for first responders such as police or firefighters, EMT, or nurses. However, you can take advantage of this civilian discount for $5-20+ off TurboTax Online products including Deluxe, Premium, and Self-Employed, and you don’t even need to enter a discount code.

Conclusion

TurboTax now offers its online products for free to active duty military. They also have some good resources for military, USAA members, National Guard, and Veterans on their blog including helpful articles about military tax deductions.

I hope that you qualify to file your Federal and State taxes for free, but if not, at least you can save up to $25 on TurboTax.

We have more discounts for the military including Fanatics for military and the Factor 75 hero discount!

This page was created in 2023 and updated for 2024. Thanks for stopping by Pretty Sweet!