Our review of H&R Block Self-Employed software: H&R Block has a version of it’s tax software specifically for the needs of small business owners, Uber drivers, and the self-employed.

Their new and improved Self-Employed Online edition includes enhanced tools to maximize potential business deductions, and it’s never been easier to file your Schedule C taxes online.

Thinking of using H&R Block Self-Employed to file your taxes? Read on to learn all about the features, reviews, cost, and best coupon.

H&R Block for the Self-Employed (Uber, Too!)

The economy has changed a lot in recent years with more Americans starting businesses, freelancing, and having more than one income stream. Popular side-gigs include Uber and Lyft, as well as freelance web design & development, blogging, consulting, or those with an online store.

The two big names in tax software for the self-employed continue to be TurboTax (coupons) and H&R Block. These brands are constantly evolving, and are the best way for a self-employed entrepreneur to maximize their tax deductions.

Here are the features of H&R Block Self-Employed:

Their Self-Employed software is both PC and Mac compatible and includes all of the features of their Premium Edition including: W-2 Snap-a-pic, Easy Import, Free federal e-File, one-on-one support, Data Security, and free Earned Income Tax Credit.

However, Self-Employed is designed specifically for entrepreneurs and small business owners, so it also includes these valuable features:

- Small Business Income (Schedule C) – Quickly and accurately report the profits and losses from freelance and independent contractor income

- Tax Deductions & Asset Depreciation – H&R employs extremely smart software with the help of Watson, who is basically a killer AI robot hell bent on getting you every deduction you deserve for your maximum tax refund

- Stride App is included with Self-Employed and tracks business expenses, mileage, and receipts daily from your phone. Never miss a deduction, and no need to wait until tax season to crunch numbers

- Uber-Friendly – If you are a ride-share driver through Uber or Lyft, H&R Block will easily import all of your income from 1099-K and 1099-Misc from your account

- Final Review By a Tax Pro – Your review will be reviewed by a professional before being submitted to the IRS to make sure you didn’t miss a single deduction or tax credit. More features

H&R Block now also includes their proprietary Business Partner™ and Business Booster™ products to maximize your small business deductions from expenses and startup costs. RefundReveal™ also explains why your refund changes in real-time.

*Related: How Much Does H&R Block (Online, In-Office) Really Cost?

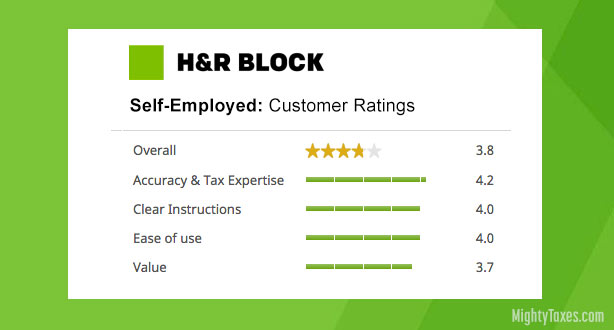

Self Employed: Customer Reviews

So, what do users say about H&R Block’s Self-Employment software? The best place to find honest reviews is actually on the product pages at hrblock.com.

In this case, well over 1000 real customers share their honest reviews, both good and bad, which you can easily sort through. We read through hundreds of reviews (and our eyes are blurry!) so here’s what we learned:

• Good Reviews

Here are the top compliments from positive reviews:

- Simple: Self employed users reported over and over how simple the installation and user-friendly filing process is, as H&R Block walks you through the process step-by-step with clear instructions

- Price: In general customers were very happy with the final price, which is usually much less than employing the services of a CPA. Customers who had switched from TurboTax seemed pleased that H&R Block was less expensive

- Accuracy – H&R Block guarantees that they will get you the biggest refund, and customers are generally happy and even surprised by the size of their federal refund

• Negative Reviews

“This year I had so many problems with Self-Employed. I had to go digging for exemptions I knew existed (office rental space for instance) and then my tax pro didn’t have access to it…”

OK, this isn’t a Jimmy Buffet concert! We’re talking about doing taxes here, so of course people have complaints! Here are the top complaints about Self-Employed:

- Time Consuming – Users who left a bad review often complained that filing their taxes took longer than expected

- Prefer In-Store File – H&R Block has hundreds of locations throughout America, and some users complained that they liked working directly with an accountant for their complex business taxes

- Cost: While most people listed price as a highlight, others complained about an unexpectedly high cost. In most instances this was due to having to upgrade from the Premium edition because of the complexity of their taxes, while others didn’t like the $39.99 State filing fee. Ok, let’s talk more about cost.

You can read more customer reviews for Self Employed here. Now, let’s talk about the cost:

*Need business cards? We have exclusive coupons for Vistaprint here! /p>

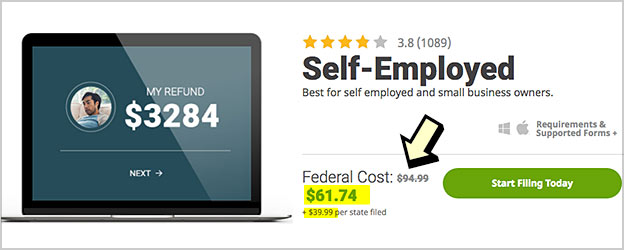

H&R Block Self-Employed Cost:

The regular online price of H&R Block Self-Employed is $105, plus a state filing fee of $39.99 per state.

However, don’t pay retail, as that cost drops significantly when you use a key code or coupon.

Customer reviews were mixed when it came to the price of H&R Block’s Self-Employed software, but most users felt that it was surprisingly inexpensive. Here’s what you should know about the cost of Self Employed:

- Online is cheaper than in-store: If you’re in an big box or office store during tax season, you’ll probably see the aisles filled with boxes of tax software. However, when you buy the actual cd or DVD you pay up to $30 more. For the best price go online

- File early if possible: The best discounts for Self-Employed, and all HR Block software are early in the tax season. Once you start to get close to the deadline the discounts from coupons and promo codes can shrink

- State eFile is extra: While it is possible to avoid the $39.99 state filing fee early in the tax season, you can’t avoid it in April

- Use a coupon: Don’t just go directly to hrblock.com as coupon and many tax-related sites have great coupons for H&R Block software for up to 35% off that really bring the cost down.

- Amazon refund bonus: Optional 5% bonus if you choose to put money on an Amazon gift card.

- Best refund guarantee: Just like competitors (like Jackson Hewitt) H&R Block now guarantees you’ll get the biggest refund possible.

*Related: Did you know that H&R Block Has a special edition for Military?

Bet Price on Self-Employed Online? Use a Coupon!

Don’t just go to hrblock.com and pay full price! We always have a couple of great coupons for all H&R Block software available.

Here’s their featured deal for Self-Employed, or check out all coupons & key codes here.