*Update: TurboTax Self-Employed is now part of TurboTax Premium, and not a separate product. Learn more

TurboTax Self Employed Edition has become increasingly popular as more people work as freelancers, side hustlers, and small business owners. TurboTax helps those who are self-employed find every deduction they deserve. In fact, they call their Self-Employed Edition, “The perfect personal and small business tax solution.”

If you are thinking of using TurboTax Self-Employed there’s no reason to overpay. Let’s look at how much TurboTax Self-Employed costs, the best discount online, and whether it’s worth it.

TurboTax Self-Employed: Cost | Best Discount | Free | Worth It?

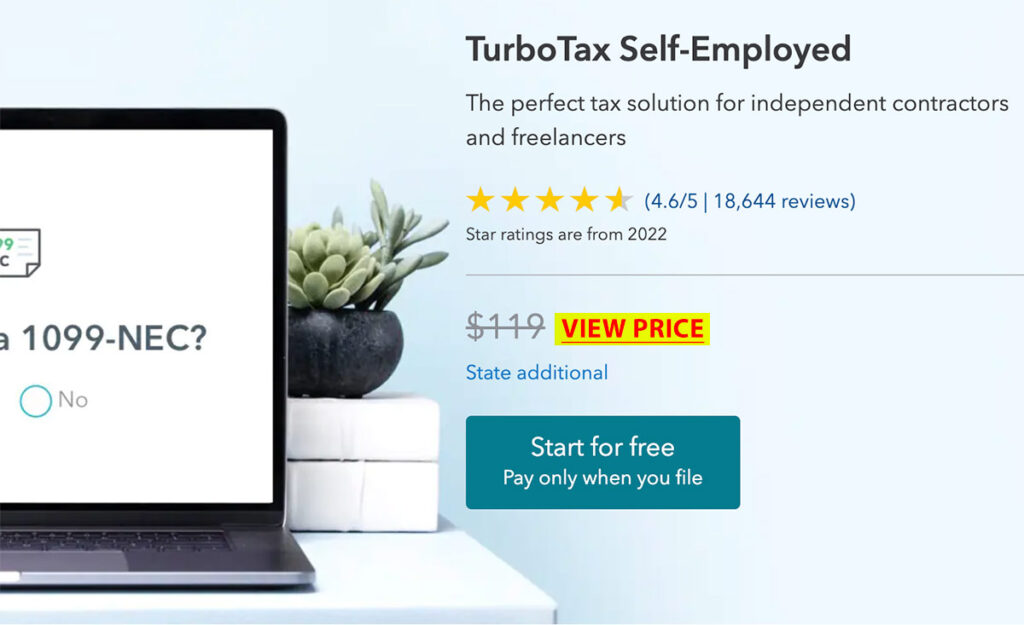

TurboTax Self-Employed Pricing:

Here’s how much TurboTax Self-Employed (Premium) costs online:

- Premium Online

$129$114 - Self-Employed Live edition:

$219$204 - Self-Employed Full Service

$409$394 - Home & Business (Self-Employed) Download CD:

$129$114

Best Discount for TurboTax Self-Employed:

Don’t just go to stores like Target or Costco to buy TurboTax because we can get you a better price with our exclusive discount. Here’s the best deal for TurboTax Self-Employed:

Top 3 TurboTax Self-Employed discounts now:

- Up to $20 off Self-Employed with code: TURBOTAX20

- Up to $15 off with code: SELFEMPLOYED15

- File before Feb. 20th to save up to $20 on Self-Employed

Is TurboTax Self-Employed Free?

How can you get Self-Employed for free? The Self-Employed Edition is not free to the public. However, some financial institutions may provide the Self-Employed Edition for free to their preferred clients.

TurboTax does have a Free* Edition, but it’s only for simple tax situations making it inadequate for those who are freelancers or self-employed. For example, you can’t enter a 1099-Misc form or access potential deductions that you might qualify for being self-employed.

*Free for simple returns only, not all taxpayers qualify.

TurboTax does have a free Self-Employed tax calculator to estimate your refund at no cost. However, your best chance at getting Self-Employed for free is probably to check with your bank or side hustle such as Uber.

How to Get the Best Price on Self-Employed

Not everyone will pay the same price for TurboTax Self-Employed this tax season. In fact, the exact price you pay for TurboTax Self-Employed depends on three things:

- When you e-file – TurboTax products, including Self-Employed, are cheaper early in the tax season before

- Optional LIVE Upgrade – TurboTax offers the help of a live tax pro with their LIVE Assisted and Full Service upgrade at an extra expense

- Promotional pricing – Use a coupon to reduce the price of the Self-Employed Edition for up to a $20 discount

For the cheapest possible price on TurboTax Self-Employed file early and use a coupon!

Tip: The Self-Employed Edition directly from TurboTax.Intuit.com is cheaper before February 20th of this tax year. After that date, expect the price of Self-Employed to increase by $10 or more!

TurboTax Tips for the Self-Employed

If you are self-employed you know the importance of every potential tax deduction. In fact, a single missed deduction can cost you hundreds of dollars or more on your Federal tax return. Here are some tips for freelancers and the self-employed from TurboTax:

Is Self-Employed Worth the Extra Cost?

TurboTax Self-Employed Edition is consistently ranked as one of the best tax software for freelancers and those who are self-employed. To help you decide whether it’s worth the price, let’s look at what you get:

- Industry-specific tax deductions

- Searches for 500 potential tax deductions

- Unlimited employee tax forms

- Home office expense help

- Ideal for 1099-NEC income

- Calculate asset depreciation

- Mileage & vehicle deductions

- Simplified Schedule C filing

- Import from QuickBooks Self-Employed

- View all features here

As you can see, TurboTax Self-Employed is packed with features for the relatively low. Also, consider that missing a single deduction can cost you a lot of money, so going with cheaper or second-rate tax software probably isn’t actually worth the risk and small savings over buying a cheaper edition like Premier.

In my opinion, TurboTax Self-Employed is a great investment and delivers a lot of features for the price. However, you should still compare it against the “Self-Employed” editions of a short list of other top brands including H&R Block and TaxSlayer.

I hope you have a lot of capital gains from your business or freelance work to report this year. I also hope we were able to educate you on the price of TurboTax Self-Employed while providing you with the best discount.

Thanks for stopping by Mighty Taxes!