H&R Block is known as the company that doesn’t just get your taxes done, they get them “won.” That is, at least according to one of their super catchy slogans.

Hmmm… well, if taxes are a game to win, you could say they’ve hired a ringer to join their team. IBM’s AI whiz, “Watson.”

So, just how does Watson change the tax-game?

What is IBM’s Watson?

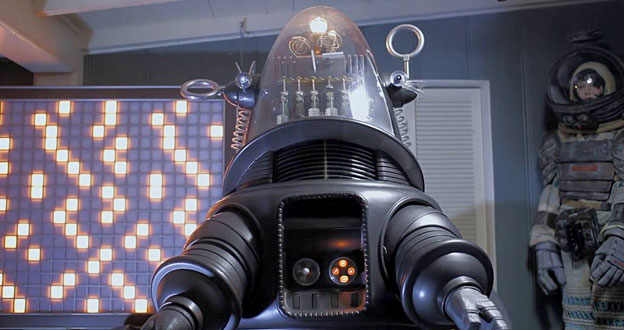

IBM’s Watson is an AI technology that has the ability to learn and process information unlike what we’ve seen before. This is called cognitive computing.

The basic makeup of IBM’s Watson is the ability to search through learned data. This works much like Google, which searches through indexed pages all across the internet to come up with the best answers to your inquiries.

“Elementary, my dear, Watson!” (Sorry, I had to say it)

IBM’s Watson, however, has an incredibly intelligent grasp of semantics. It can understand words in context and draw sophisticated conclusions the same way a human brain could, just faster.

Watson is being applied to many fields, including retail and medical. The medical field uses Watson to help healthcare professionals better manage data, medical literature, and so on. This allows them to spend more time solving problems and less time researching them.

Watson is being applied to other fields as well, like tax preparation, for example, through IBM’s partnership with H&R Block.

IBM’s Watson and H&R Block

H&R Block partnered with IBM’s Watson to present an efficient and thorough tax preparation experience to its customers.

H&R Block professionals taught Watson all of the many intricacies of the tax code, on both the federal and state level. Each time the government changes or introduces a new tax law, they’ll teach Watson the update as well.

Additionally, Watson learned about thousands of past interactions between tax preparers and filers. This helps it to determine common questions, missed deductions, and so on. This was then cross-checked by the H&R Block tax experts.

Through this process, Watson continues to gain a deeper understanding of how taxes and tax returns work.

This massive indexing of information helps Watson determine everything that could relate to you. This gets you the most accurate tax preparation and the biggest possible return.

Watson does this by comparison. It looks at things like income level, filing status, life events, and occupation of other customers similar to you. This helps it to determine if your taxes are being prepared in the most beneficial way possible.

*New: How Much Does Filing w/ H&R Block Really Cost?

One of the coolest things about IBM’s Watson is the customer experience. On all 80,000 desks of H&R Block tax preparers, there will be two Watson computers, once facing the tax preparer, and the other facing the customer.

This hands-on interaction helps customers learn how different filing options affect the outcome of their tax return.

Also, it helps the customer remember any life events or financial events happened over the last year that they could be forgetting.

This will help to make sure their taxes are accurate and thorough.

Because of Watson’s ability to learn from interactions and experience, the technology gains even more value over time.

How Does This Affect The Accounting Industry & Filing Taxes?

The thing about Watson that gives H&R Block such a cutting edge is the expertise. While a tax preparer may be an expert on tax law, they are not necessarily an expert on every individual customer’s occupation and life events.

Watson is able to not only understand the intricacies of tax law, it can index the human experience, at least the tax-related human experience.

This gives H&R Block the ability to essentially specialize in every occupation and circumstance. By learning from experiences across the company, they won’t miss any deductions or credits.

Watson isn’t the only example of AI in the accounting industry. Accounting and computers are a natural pair, so it’s no surprise that AI is becoming more and more integrated into the field.

This technology saves time, increases accuracy, and reduces costs, so it is, without a doubt, here to stay.

Uh, oh. More jobs replaced by robots?

That doesn’t mean that accountants should fear that their job replacement by computers or giant robots anytime soon. The accounting professionals still have to work through and approve the final tax preparation. The process, however, accelerates significantly with the use of this smart technology. In fact, wouldn’t be surprised if TurboTax adds some kind of AI to their software in the next year. (Or, maybe some kind of non-threatening robot, like WALL-E?)

Accounting experts are still needed to teach AI technology like Watson of the many updates to tax law that happen every year.

The part of the accounting industry that could see a hit in employment is the administrative side. Businesses will need fewer employees to do the research and indexing work that cognitive computing can now do. This could result in fewer jobs, which is the main point of controversy behind AI technology.

H&R Block Says, “Don’t Worry, Human!”

H&R Block insists that the use of Watson will “in no way or shape or form” replace any jobs.

Really!? I’ve heard that before. In fact, when I was in college, I never thought a robot could replace me and my telemarketing talents, but it happened. I guess I just couldn’t compete with a machine that can call 20 people at once. (Although, when I drank coffee, I was pretty fast at dialing!)

“Excuse me sir, can I interest you in a discount subscription to the Wall Street Journal? With every subscription you’ll also get a free… hello?… Hello?”

I mean, how do you replace human talent like that!?

Are you on board to try out this new technology in an H&R Block near you? Join the conversation on our Facebook page!

If you plan to do your taxes at home this year with H&R Block tax software, be sure to use this coupon for up to a 35% discount.

MightyTaxes.com is your go-to resource for all things tax-related. We share news, preparation tips, and coupons for home tax preparation software, and more!