QuickBooks Payroll is an online payroll solution for small and medium-sized businesses that helps automate and streamline the payroll process. The software allows users to run payroll, pay employees via direct deposit or check, file taxes, and generate tax forms. QuickBooks Payroll integrates with QuickBooks Online and Desktop (coupons here), making it easy to manage finances and payroll services in one place.

So, how much does QB Payroll cost? Payroll costs between $45-160 per month depending on what features you need, the number of users, and whether you want just Payroll or bundled with their bookkeeping software. Here’s today’s best promotion for up to 50% off plus how much QuickBooks Payroll costs now.

QuickBooks Payroll Cost: Best Deal | Bundle Pricing | Payroll Only | Worth It?

Best Deal for Payroll:

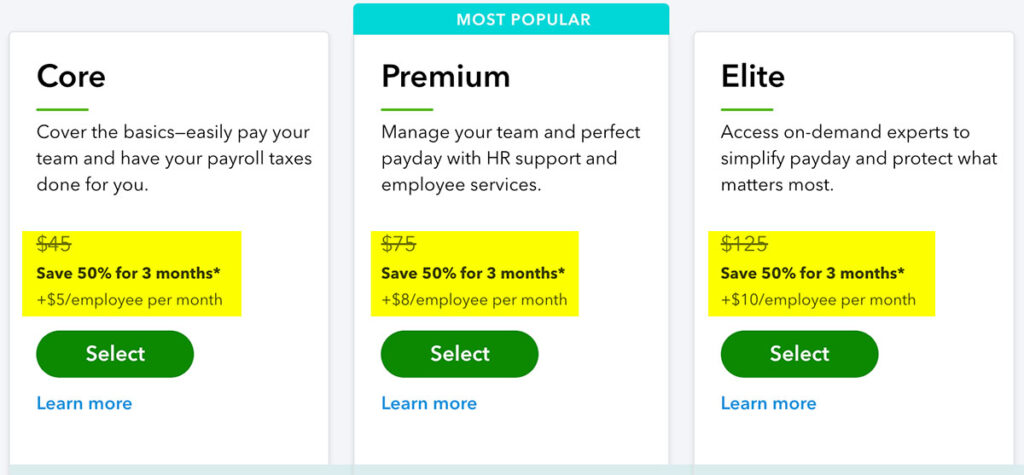

Before we look at the regular pricing for Payroll, here’s the best promotion now for up to 50% discount on the first 3 months:

Once the initial promotion for Payroll ends you’ll be billed monthly at the regular price. Here’s how much you can expect to pay for Payroll bundled or a la carte:

QuickBooks Payroll Pricing for 2023:

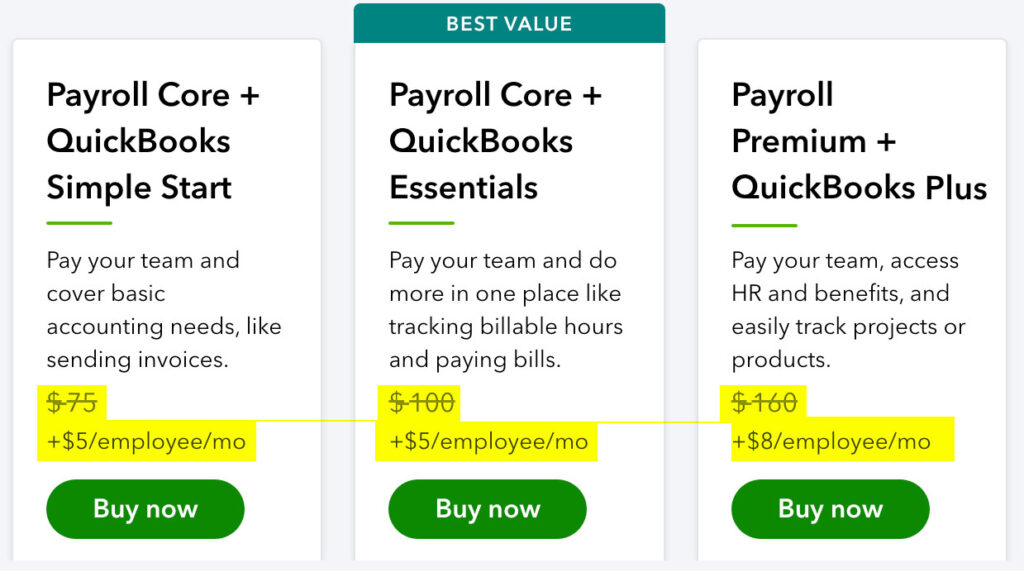

The most popular way to buy QuickBooks Payroll is bundled to work seamlessly with their online bookkeeping software although you can also just buy only Payroll. Here’s how much it costs: ‘s the pricing for each option:

1. Payroll Bundled Cost:

- Payroll Core + Simple Start: $75 + $5/employee per month

- Payroll Core + Essentials: $100 + $5/employee per month

- Payroll Premium + QB Plus: $160 + $8/employee per month

Do you only need Payroll? Click the link next to bundle pricing on quickbooks.intuit.com that says, “Just need payroll?“

2. Pricing for QB Payroll only:

- Payroll Core: $45 + $5/employee per month

- Payroll Premium: $75 + $8/employee per month

- Payroll Elite: $125 + $10/employee per month

How to get the best price: You can save on QB Payroll with Intuit’s current promotion of 50% off the first 3 months. Not sure if Payroll is best for your business? They also have a 30-day free trial here.

*Related: TurboTax Full-Service for Business Review

Is QuickBooks Payroll Worth the Expense?

QuickBooks Payroll is a significant monthly expense. So, is it worth the cost? If time is money then top-rated QB Payroll might be an amazing investment and time-saver for your small business. Here are the top reasons why QuickBooks Payroll is worth the price.

- Time and Cost Savings: QuickBooks Payroll streamlines the payroll process and automates many tasks, saving small businesses valuable time and reducing the likelihood of errors. Additionally, by automating tax calculations and filings, businesses can save on costly penalties and fees.

- Compliance: QuickBooks Payroll stays up-to-date with the latest tax laws and regulations, ensuring that small businesses remain compliant with all legal requirements. This can help businesses avoid legal issues and reduce the risk of audits which could be priceless!

- Integration with QuickBooks: QuickBooks Payroll seamlessly integrates with QuickBooks Online and Desktop, providing a centralized location for managing finances and payroll. This integration can help small businesses better understand their financial health and make more informed decisions about their operations.

Is QB Payroll worth it? Even though Payroll adds yet another monthly expense for your small business, it should add tremendous value and potentially saves hundreds of hours per year by simplifying, organizing, and automating payment and finance tasks.

Payroll Saves Time & Money!

QuickBooks Payroll enables you to pay employees and manage your bookkeeping in one place. While Payroll is a significant monthly expense, it’s likely an invaluable time-saver and investment for your small business.

*Related: How Much Does QB Self-Employed Cost?

Thanks for visiting Mighty Taxes!