QuickBooks Self-Employed is a cloud-based accounting software from Intuit for freelancers and independent contractors to manage their finances and track their expenses, mileage, and invoices.

QB Self-Employed offers a simple and user-friendly interface with useful features to help self-employed individuals stay organized and on top of their financial obligations. Speaking of finances, let’s talk about how much QuickBooks Self-Employed costs!

QuickBooks Self-Employed: Cost | Best Price | Worth It?

QuickBooks Self-Employed 2023 Cost:

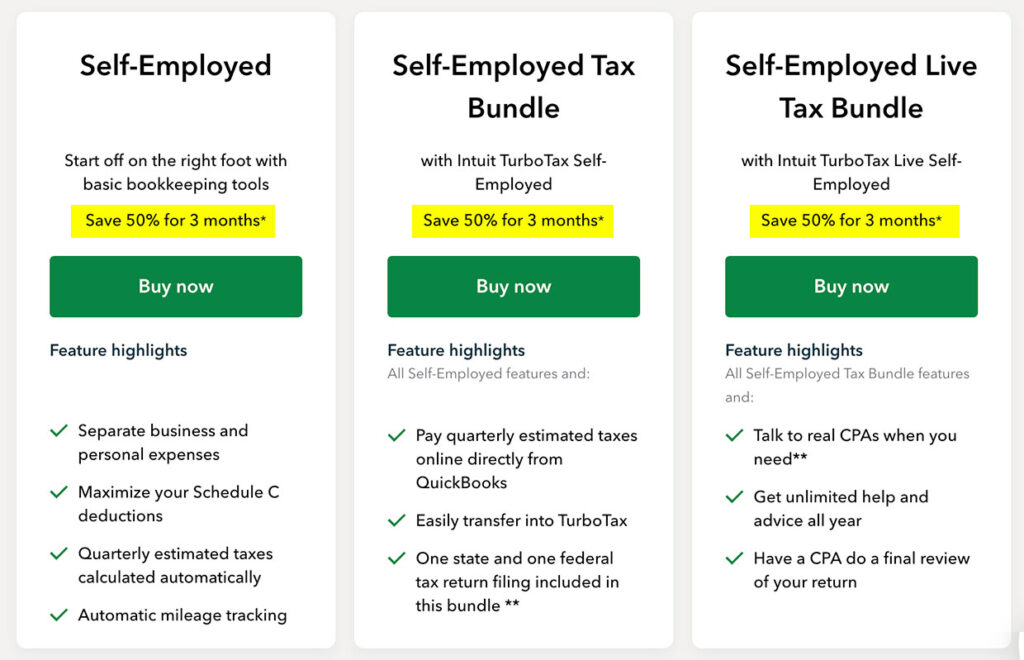

How much does QuickBooks Self-Employed cost? You can buy Self-Employed Online a la carte or bundled together with TurboTax directly from Intuit.

Here’s the latest subscription pricing for QuickBooks Self-Employed once the initial promotion ends:

- Self-Employed: $15/month (50% off with coupon)

- Self-Employed Tax Bundle: $25/month includes TurboTax Self-Employed

- Self-Employed LIVE Tax Bundle: $35/month with TurboTax Self-Employed Live

QB Self-Employed is billed monthly until you cancel which will become effective at the end of the monthly billing period. There are no cancellation fees nor prorated refunds for any remaining days in your final month.

Teachers may be able to provide QuickBooks to their students at no cost. You can see today’s pricing for Self-Employed on the Intuit website here including their featured promotion.

Best Price for QuickBooks Self-Employed:

How do I get the best price on QuickBooks Self-Employed? To get the best deal on QB Self-Employed, buy it directly from Intuit here where they have a promotion for 50% off your first 3 months.

I recommend that you consider the Intuit Self-Employed Tax Bundle which includes the TurboTax Self-Employed Edition at a discounted price.

Tip: The best price for QuickBooks Self-Employed is usually early in the tax season. We list all of the latest QuickBooks coupons and offers here to ensure you get the best price today!

Related: Vistaprint Coupons: Up to 25% Off

Is QuickBooks Self-Employed Worth the Cost?

QB Self-Employed has a lot of valuable features that make the software indispensable for self-employed workers, freelancers, and contractors. The QuickBooks brand is also unrivaled and has been the #1 software choice of small businesses and the self-employed for decades.

Wondering what you get for your money? Here are 3 top reasons why QuickBooks Self-Employed is likely worth the investment:

- Simplified Bookkeeping: QuickBooks Self-Employed helps freelancers and self-employed individuals track their business income and expenses in one place, making it easier to manage their finances. This can save valuable time and money, and reduce the likelihood of errors.

- Tax Deduction Tracking: QuickBooks Self-Employed automatically tracks and categorizes deductible expenses, making it easier for freelancers and self-employed individuals to claim tax deductions at the end of the year. This can help save money on taxes and increase overall profitability.

- Invoicing and Payment Tracking: QuickBooks Self-Employed allows freelancers and self-employed individuals to create and send invoices, track payments, and even accept online payments. This can help improve cash flow and make it easier to get paid for work completed.

As you can see, QuickBooks is packed with valuable features that should make it a shrewd investment for freelancers and those who are self-employed. Therefore, my opinion is that it’s well worth the investment.

Tip: If you have a multi-billion dollar financial company like FTX you’ll need something more than QuickBooks Self-Employed to run your business, even though that’s what they actually used!

Think of QuickBooks Self-Employed As an Investment In Yourself and Your Business:

QuickBooks is not the cheapest software for freelancers and the self-employed, but you can argue that it’s the best. Actually, QuickBooks Self-Employed is usually at or near the top of every credible list of the best accounting software for the self-employed Forbes and Motely Fool. So, why trust second-rate or cheap accounting software to manage your business?

I hope we were able to clarify their pricing and point you toward the best price. Thanks for stopping by Mighty Taxes!