So, you’ve just e-filed your taxes with TurboTax. Congratulations! Hopefully, the IRS will accept your refund and then quickly process your refund. In the meantime, you’ll probably want to monitor the status of your e-file. Here’s how to check your TurboTax e-file status:

Here’s a quick recap of how to check your e-file status online or through the app:

How Do I Check My e-File Status on TurboTax? (App / Online)

- Sign in to TurboTax

- Open your return

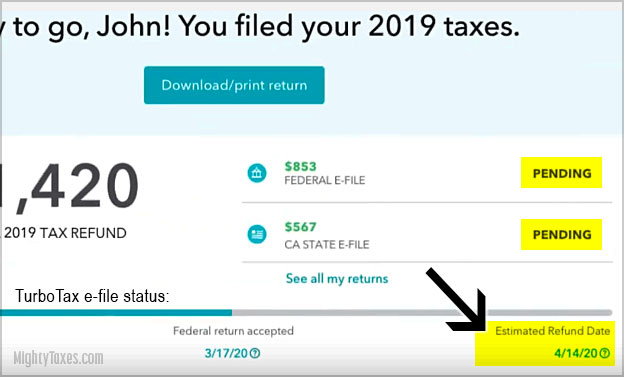

- Your e-File status should be the first thing you see

- The status of your federal and state returns will be displayed, along with an estimated refund date:

How long does it take for the IRS to accept your return?

- The IRS usually takes 24-48 hours to accept or reject a submitted e-file return

- State tax returns can take longer to process; often several days

- During this time, your status will be shown as “pending” in TurboTax

If you have questions about your e-file or refund status, TurboTax has very good customer support who can help you with your specific issue or question.

Have you filed your tax return yet? If not, we have an exclusive service code from intuit that can help you save money on the cost of TurboTax! This discount works towards all popular editions including Free, Deluxe, Premier, and Self-Employed.

Thanks for stopping by Mighty Taxes!